Sino Inno Cap gathers data on venture capital investment, trends and network structures. The VC Map outlines the major trends in key investment industries and shows interconnections in investment activities.

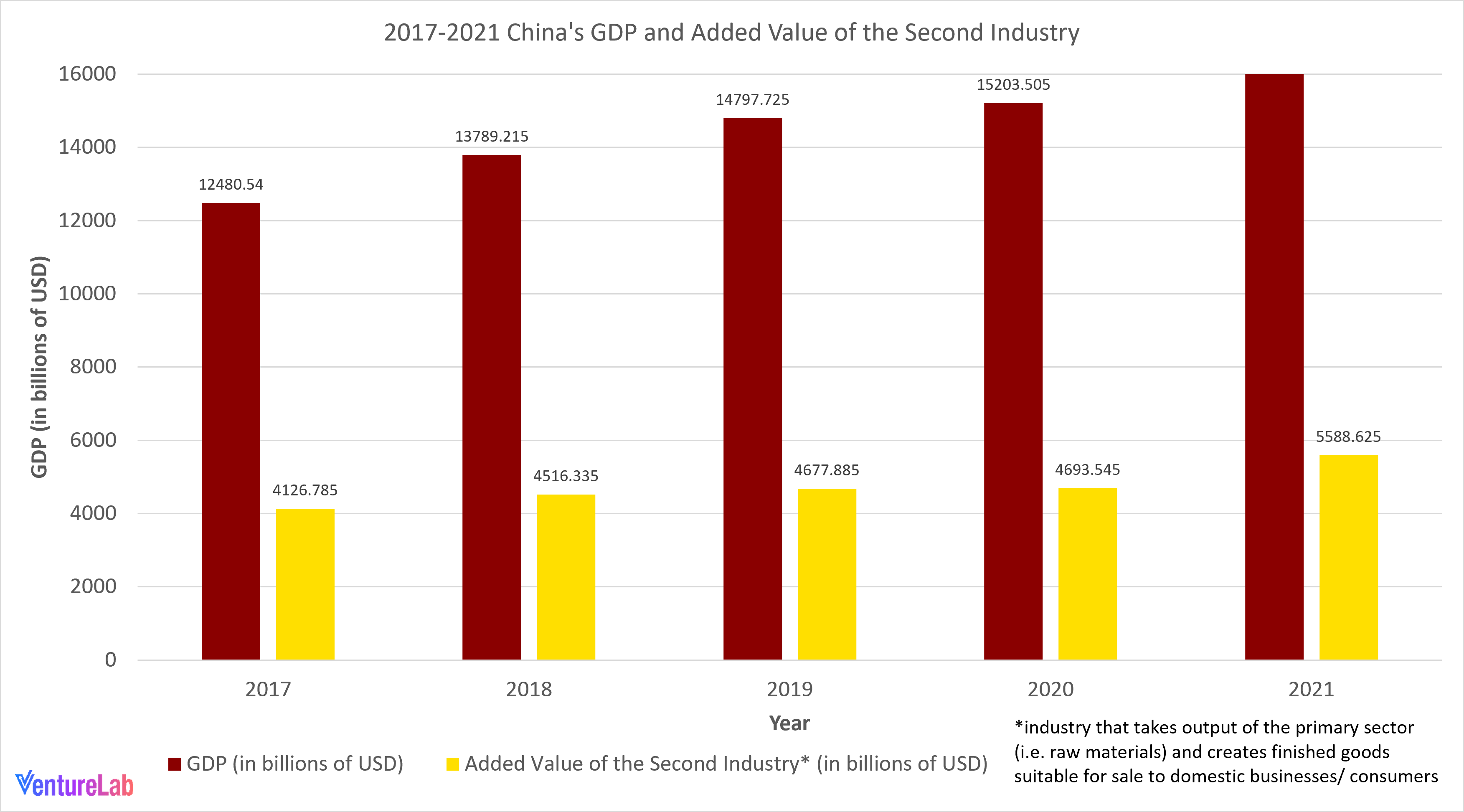

The industry map unveils nine innovative or sustainable industries that are indicative of the current trend of the Chinese economy. They are the inextricable parts of the country’s economy as they are either popular among investors (i.e. e-commerce and entertainment & media) or supported by the Chinese government (e.g. renewable energy, advanced manufacturing, etc.). Resembles the nine sons of the Chinese dragon, which is an ancient Chinese totem that represents the nation since feudal times, each of the industries projects the future industrial development of China. Explore the industries by clicking on the visual.

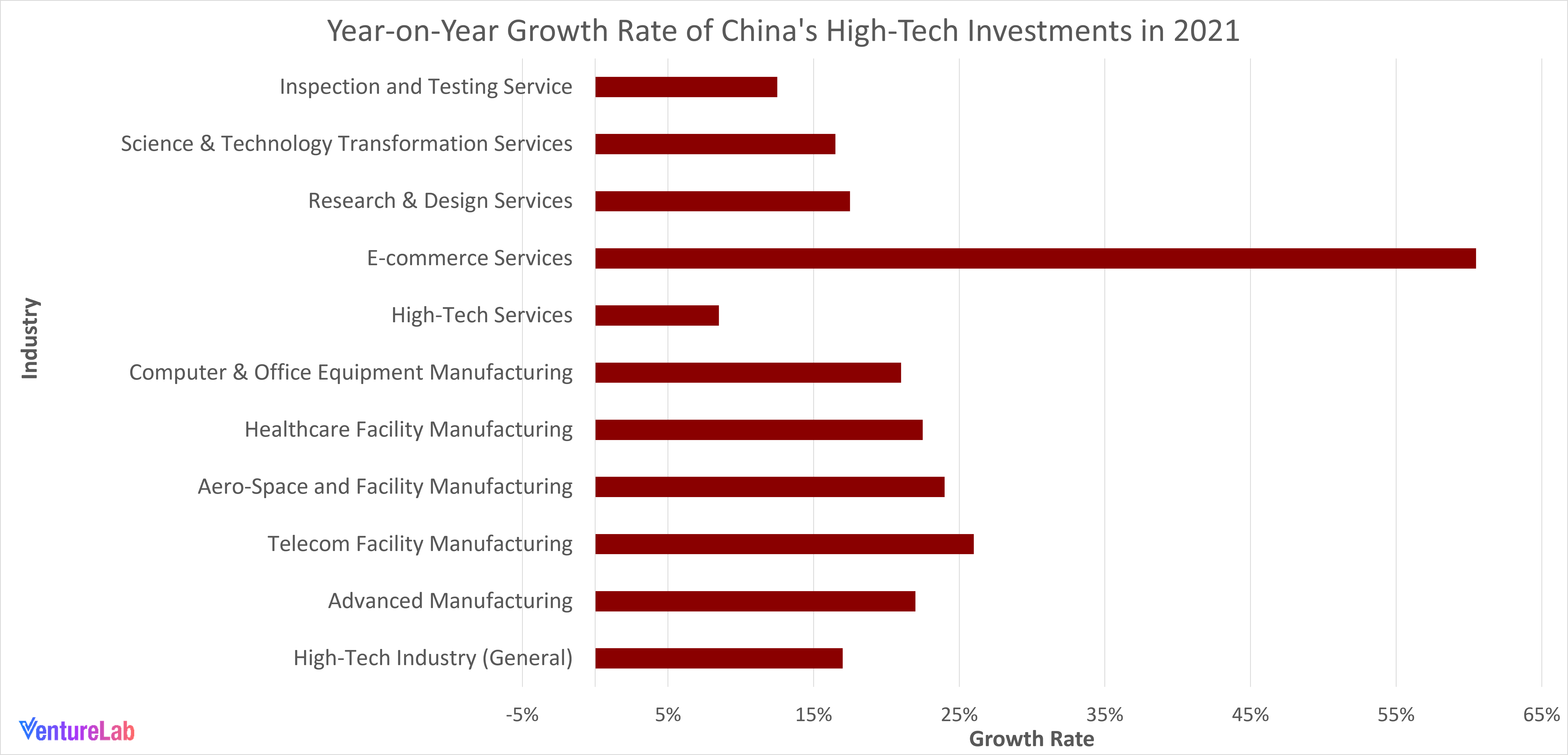

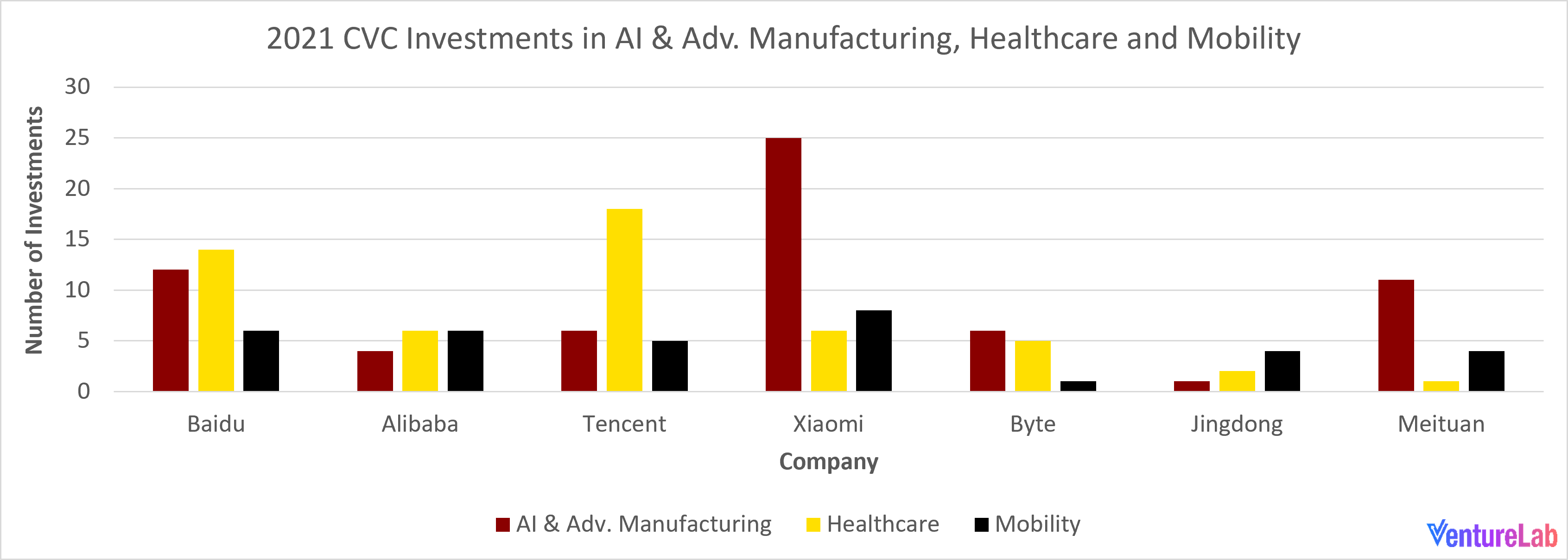

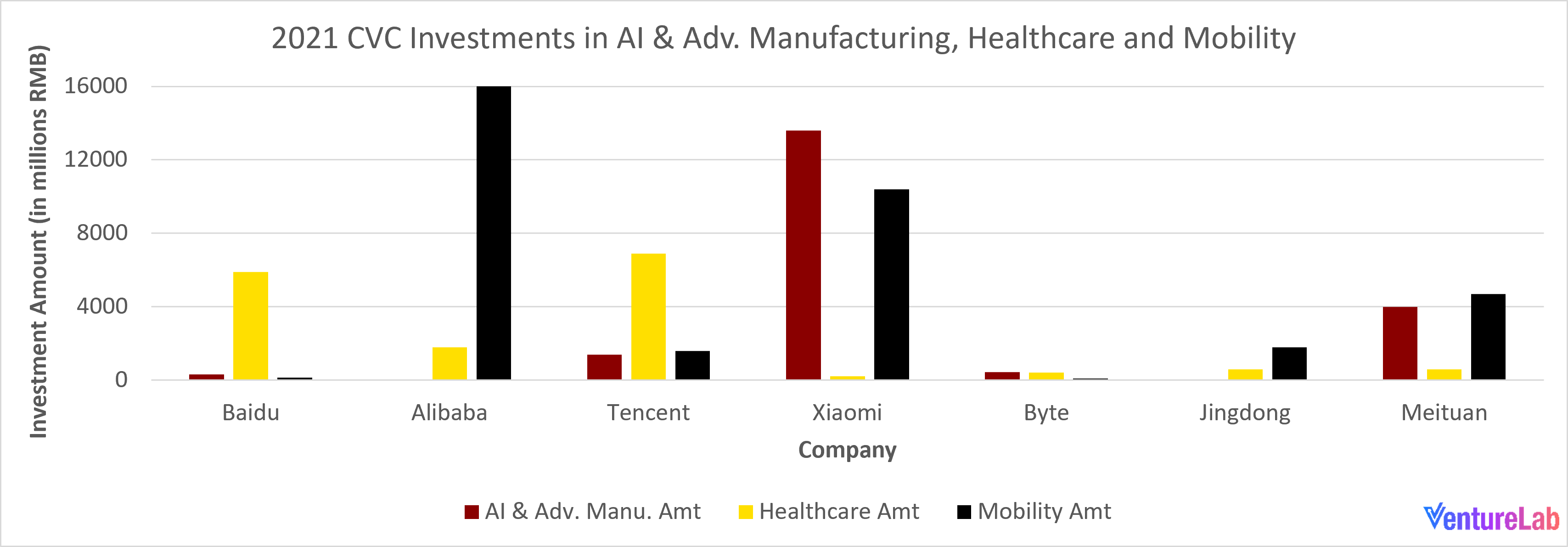

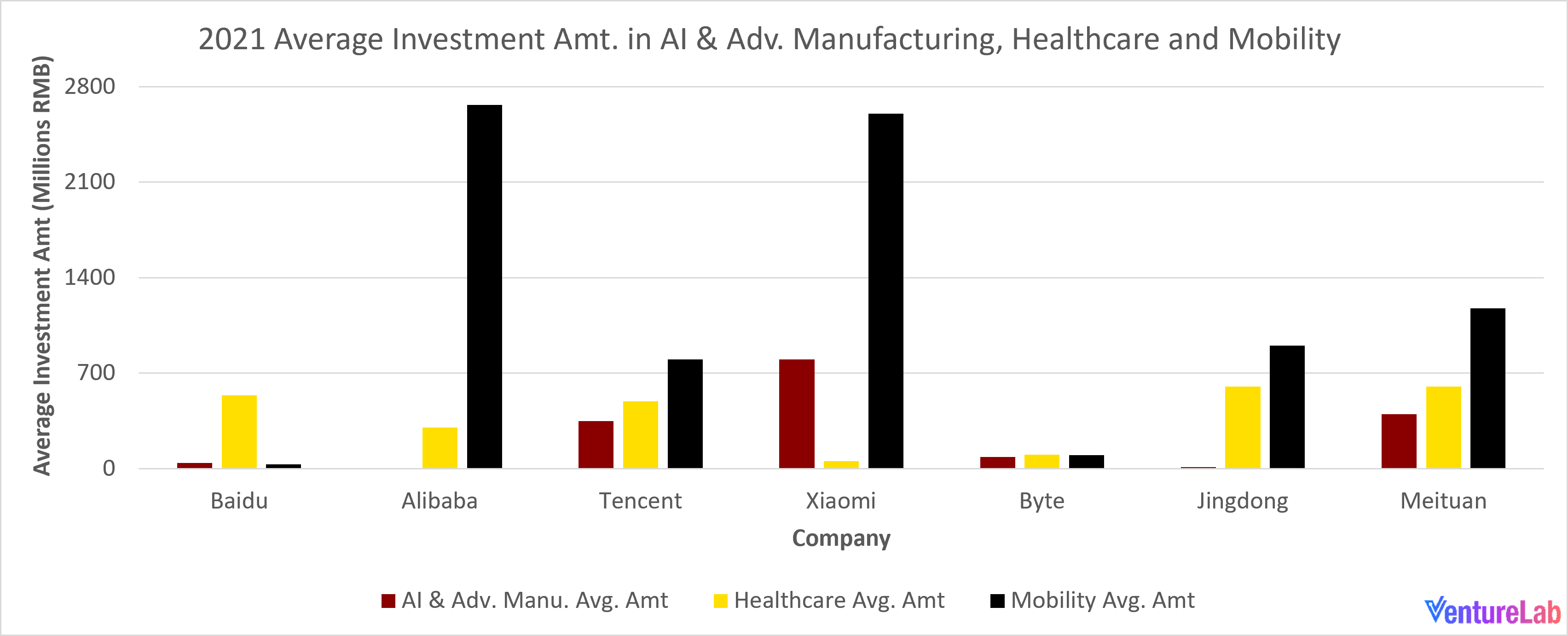

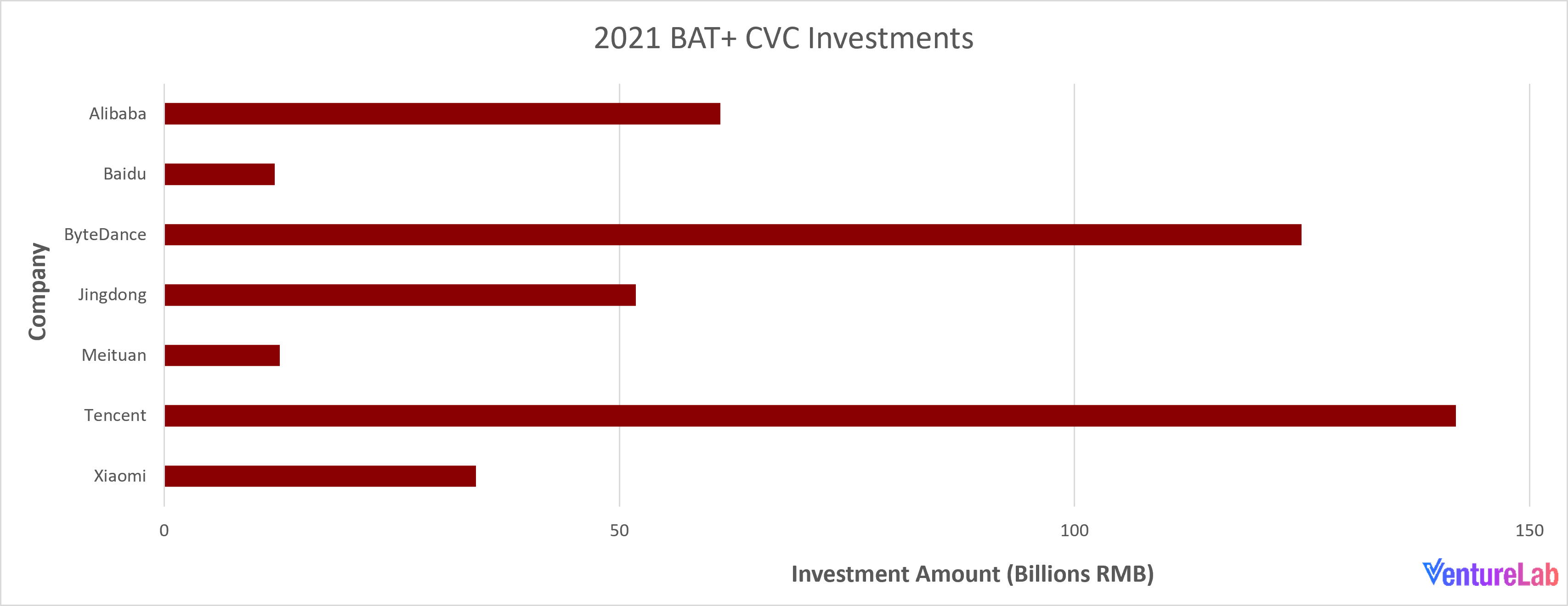

Three megatrend industries that define the 21st century are highlighted: AI & Advanced Manufacturing (from the national plan Made in China 2025), Healthcare (to against COVID-19), and Mobility (accelerating China’s urbanization progress). The lion share of CVC investment activities surrounding those trends are performed by seven Chinese Internet Giants.

Big Tech Venture exposes the distinctive ways the seven Internet Giants lead in the Chinese CVC realm. Each of the bubble charts exhibits their investments decisions since the year of 2000 that somehow shape China’s CVC landscape.

VC Disruptors unveils China’s most innovative firms, i.e., the corporates that invest heavily on R&D and innovation projects. The disruptors are pushing the Chinese technology industry forward, reshaping the country’s future development.